Hertta-Maria Amutenja

The City of Windhoek has stated that its financial struggles are exacerbated by a growing population, urbanisation and the provision of services that should be funded or subsidised by the government.

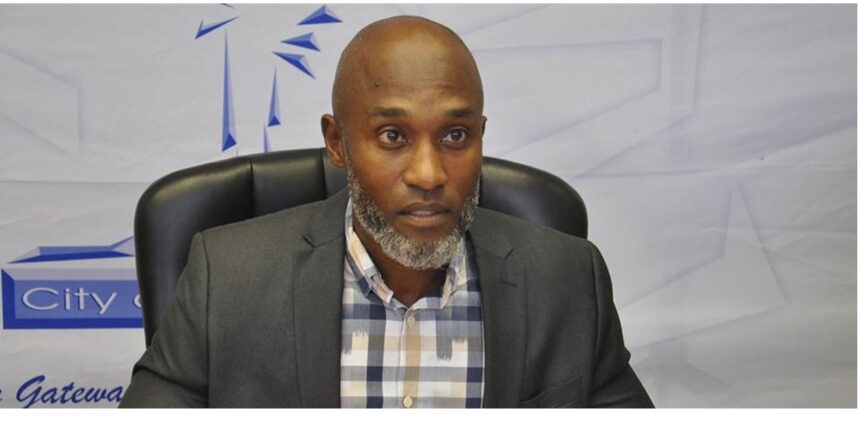

This was conveyed by the city’s spokesperson, Harold Akweenye while responding to questions on the city’s current financial status after it was reported last year that the city is surviving on a N$200 million bank overdraft every month to pay salaries and other expenses.

Akwenye is of the opinion that for the city’s financial status to improve, urbanization should be minimized and the government should avail funds to cater to some basic services.

“As the only cosmopolitan city in Namibia, we have a high number of people moving in due to urbanisation, and most of them cannot afford our services. However, we have to provide services to them. As a result, there has been an exponential increase in expenditure, exceeding the growth in revenue.

Simultaneously, the council offers services that should ideally be funded, or at the very least, subsidised by the Government, such as emergency, ambulance services and bus services. However, we have not received any sustained appropriations from the Government,” said Akweenye.

He added that this is an issue the council continually discusses with the government, and the city has relied on a significant overdraft facility, which was initially N$ 400 million but it has now been reduced to manage day-to-day operations. Adding that if it was not for Covid-19 outbreak, the overdraft could be at N$100 million or less by now.

“This amount has remained unchanged since mid-2020, which speaks to the stability of our financial management. It should be noted that our debt ratio is very low, at 16.63 percent of assets, and the council safely and efficiently utilises this facility. It has improved over the years. Our current cash collection rate is 100 percent, including arrears as evidenced by stable debtors’ balances over the last two years,” he said.

The city found itself in the midst of a financial quagmire last year when Independent Patriots for Change councillor Jürgen Hecht, brought the city’s financial woes to light.

Hecht’s assessment highlighted several concerning figures, including a cumulative loss of N$3.2 billion over the past decade, an annual wage bill of N$300 million, a N$100 million employee vehicle scheme, N$70 million losses on bus services and a post-retirement medical aid scheme.

Hecht’s revelations extended to the city’s labour force when he highlighted that city employees are among the highest-paid in the country. Some receive salaries that are over 144 percent higher than market-related rates, while certain employees earn a staggering 600 percent above the market rate in the lowest salary bracket.

In response to these, Akweenye said the city has explored alternative financial strategies beyond relying on overdraft facilities to manage its day-to-day operations, such as not increasing salaries for the last three years, and efforts to improve property tax collection and address defaulters have been undertaken.

“Furthermore, we have conducted stand audits to ensure that all properties and clients are levied correctly in terms of zones, all in the system. We have also expedited the interim valuation. We have taken aggressive measures against defaulters to enhance collection, as confirmed by media reports,” said Akwenye.

Leave a Reply