By Yuen Yuen Ang*

Washington, DC – “In an increasingly performance-oriented society, metrics matter. What we measure affects what we do,” argued the 2008 report of the Commission on the Measurement of Economic Performance. “If we have the wrong metrics, we will strive for the wrong things.”

The Commission was challenging the primacy of GDP as the metric of development. But the same observation applies to corruption, which is conventionally – and misleadingly – measured as a one-dimensional problem.

Global corruption indices, including Transparency International’s Corruption Perceptions Index (CPI) and the World Bank’s Control of Corruption Index, assign a single score to countries. These metrics consistently show that rich countries are “very clean” while poor countries are “highly corrupt.” For example, the 2023 CPI ranks the United Kingdom (scoring 71) as the world’s 20th least corrupt country, much cleaner than China (42) and Brazil (36). Most CPI users, including media outlets, companies, and analysts, interpret these numbers as a fact.

But are richer countries really less corrupt than poorer ones? One-dimensional metrics like the CPI obscure the fact that qualitatively different varieties of corruption cannot be reduced to a single score. These metrics also systematically under-measure what I call “corruption of the rich” – which tends to be legalized, institutionalized, and ambiguously unethical – as opposed to “corruption of the poor.”

In poorer countries, corruption takes clearly illegal and outrageous forms, such as stealing public funds and taking bribes. In rich countries, by contrast, many believe the problem has disappeared.

In The Quest for Good Governance, Alina Mungui-Pippidi even concludes that advanced economies have reached an end state of “ethical universalism,” where “equal treatment applies to everyone.” Britain is “the classic historical performer” in this respect, followed by “British empire splinters populated mostly by populations of European descent.” In short, the rich West is clean.

But given the rise of populism in high-income democracies today, much of it a backlash against the outsize advantages enjoyed by the rich and politically connected, “ethical universalism” seems more illusory than real. As a blistering 2020 exposé by the New York Times revealed, half of UK government contracts for medical supplies during the COVID-19 pandemic went to “companies run by friends and associates of politicians” through a special “VIP Lane.”

How, then, did the CPI rank the UK as the 20th least corrupt country? The score is based not on surveys conducted internally by Transparency International, but on a combination of various third-party polls. Almost all of these come from Western organizations such as the Economist Intelligence Unit, and they tend to rely heavily on responses from Western business executives.

Moreover, the wording in these surveys is often vague. For example, the World Competitiveness Yearbook, one of CPI’s sources, presents business executives with a crude binary choice: “Bribery and corruption: exist or do not exist.” No wonder the CPI shows that rich countries are “very clean” year after year, even as their ordinary citizens disagree.

Recognizing that there were no alternatives to these conventional metrics, despite numerous critiques (including from the CPI’s own creator), I piloted the Unbundled Corruption Index. Like the CPI, the UCI is a perceptions-based metric of corruption that relies on expert surveys. However, it unbundles corruption into four distinct varieties: petty theft (extortion by street-level officers), grand theft (embezzlement by politicians), speed money (small bribes to overcome bureaucratic hurdles or harassment), and access money (big payoffs in exchange for exclusive, lucrative privileges such as contracts and bailouts).

While the first three varieties of corruption – the ones endemic in poor countries – are brazenly unlawful and directly harmful, access money might be illegal (as with bribery) or permissible (as with campaign finance). Sophisticated methods of buying privileges may involve entire institutions where no individual is corrupt. For example, money laundering, for which London is a known hub, can involve moving funds seamlessly across borders through widely respected financial institutions. In the United States, banks collectively spent billions lobbying for lax regulations, leading to the 2008 financial crisis, yet only one banker was indicted.

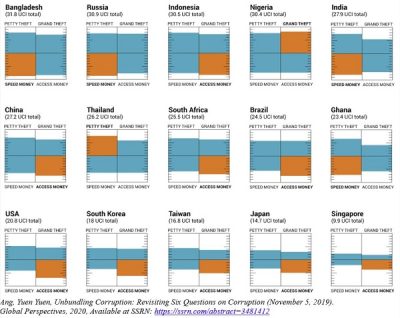

The UCI uses an original expert survey to rate all four types of corruption. To improve the quality of measurement, I employ stylized vignettes that ask respondents to rate the prevalence of specific representative scenarios rather than overall corruption levels. My prototype, covering 15 countries, is visualized below. Each country’s total UCI score appears at the top and is broken down into the four categories of corruption, with a colored box representing the most dominant type. Now we can compare not only aggregate levels of perceived corruption, but also the type and configuration of corruption across countries.

One illuminating comparison is between the US and China. The US is less corrupt than China overall, but the gap is narrowest in the category of access money, the dominant type of corruption in both countries. Notably, America’s access-money score is higher than that of lower-income countries like Thailand and Ghana. If we relied solely on bundled scores, we would conclude that the US is clean. But once the scores are disaggregated, we can explain the appeal of populist promises to “drain the swamp.”

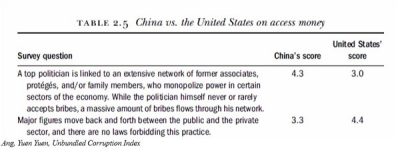

Even more interesting is that different forms of access money prevail in the US and China. In a comparison based on a vignette about bribe-taking through politicians’ personal networks, China clearly dominates. Yet when we turn to “revolving door” practices and regulatory capture through lobbying, the US takes the lead.

In short, access money in the US is primarily institutional, whereas the problem in China is still enmeshed within personal relationships involving bribery and piles of buried cash. China isn’t necessarily more corrupt than the US, but its corruption certainly has a different quality.

Mismeasuring corruption is no mere technicality. Fundamentally, it reinforces the illusory, hypocritical, and often Eurocentric message that high-income countries have achieved a lasting state of ethical purity. In reality, corruption did not necessarily disappear as countries grew richer – rather, it evolved, becoming more sophisticated and imperceptible.

We must continue to fight “corruption of the poor.” But, by unbundling corruption, capitalist democracies can also direct urgently needed attention toward some of their most pressing problems, including rising inequality, declining public trust in government, and what USAID Administrator Samantha Power calls “modern corruption” (such transnational networks of illicit finance). Overcoming these challenges requires measuring them accurately, rather than pretending they don’t exist.

* Yuen Yuen Ang is Professor of Political Economy at Johns Hopkins University, and the author of How China Escaped the Poverty Trap (Cornell University Press, 2016) and China’s Gilded Age (Cambridge University Press, 2020).

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Leave a Reply